Life disability and critical illness insurance are crucial financial tools that provide individuals and their families with much-needed security and peace of mind. These types of insurance policies act as a safety net, offering financial protection in the face of unexpected and often devastating events. Life insurance ensures that loved ones are financially supported in the event of the policyholder's death, helping cover expenses like funeral costs, debts, and ongoing living expenses.

Disability insurance steps in when an individual is unable to work due to injury or illness, offering income replacement to maintain their standard of living. Critical illness insurance provides a lump sum payout upon diagnosis of a severe medical condition, helping to cover medical expenses and other financial burdens during a challenging time. Together, these insurance types help safeguard individuals and their families against unforeseen hardships, ensuring that they can focus on recovery and well-being without worrying about financial strain.

INSURE YOU

Term

Whole Life

Visitors to Canada

Critical Illness

Travel

Corporate Group

Universal Life

Mortgage protection

Corporate tax savings policy

Prepare today for a brighter tomorrow.

Ask our specialized agents how we can create a plan for you and your loved ones.

Having disability insurance is a great choice for many reasons, including but not limited to:

Worker’s Compensation only covers work-related accidents. Conversely, your disability insurance covers a wider spectrum of circumstances

Unemployment insurance only covers 15 weeks. Your disability insurance spreads over much longer time

Medical costs can add up significantly

Government benefits are very limited. Your disability insurance bursts with benefits

Group coverage will only match a specific percentage of your income, so you might end up spending more on medication than you earn in a whole month.

For as little as $20/month you could receive your monthly income without tax deductions

Accidents and illnesses can happen virtually at any time, so having a comprehensive disability insurance policy is a must in order to counter the future’s uncertainties and ensure yourself and your family from a financial point of view.

DISABILITY

LIFE

Whether you want help covering final expenses or building a legacy, you can protect your family or business with term or permanent insurance from Goldkey. Here are the types of Life insurance polices available:

Term Policy

Term life insurance is simple and affordable , providing a fixed amount of insurance for a specific period of time

In the event of your death, the policy pays a tax-free benefit, to your beneficiaries

Term life provides temporary protection you can customize to meet your changing need

Permanent Policy

Permanent life insurance is often called whole life insurance because it covers you for your whole life and some types can build cash value over time.

Permanent insurance costs are usually guaranteed not to increase from the time you first buy the policy.

Some permanent insurance plans let you pay for a limited time and then you don't have to pay any more.

Participating Permanent Policy

Participating life insurance is a type of permanent whole life insurance coverage that can be eligible to receive dividends.

The amount of coverage you choose and your premiums are guaranteed for life.

You can use the dividends to buy more coverage, reduce your annual premium cost or earn interest inside the plan. Or you can take them in cash. Dividends are not guaranteed.

Universal Life Policy

Universal Life is a flexible type of permanent life insurance that combines protection and savings.

You choose a guaranteed death benefit that your beneficiaries will receive.

The payments you make above the cost of insurance earn tax-preferred interest

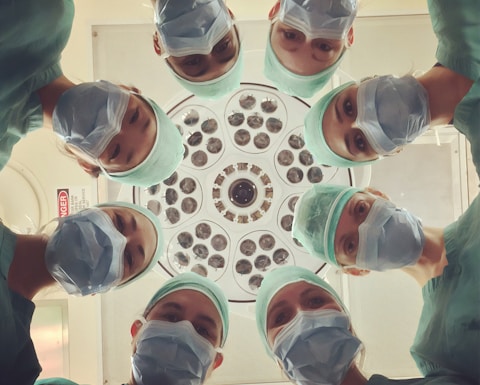

Having to go through a critical illness (without insurance) is a very physically and mentally destructive experience. So much so that the afflicted person might not be able to necessarily cope with the inherent financial impact that comes out of the blue as a result.

Recent studies reveal a harsh reality. It is estimated that over a whopping 70,000 heart attacks happen in Canada on a yearly basis, along with a disheartening 3,075 new cases of cancer diagnoses each week. If you are caught unprepared, the consequences could be potentially dire. The aftermath is simply inconceivable. What can Goldkey offer:

You receive a tax-free, lump-sum benefit after satisfying the waiting period if you’re diagnosed with one of 24 critical illnesses

Receive partial benefit (25% payout up to $50,000) in the event of a non-life threatening illness, Receive a monthly Care Benefit if you need long term care

If you develop a critical illness, you may need to take time off work, arrange additional care for your children, travel to specialized treatment centres and more. Help give yourself financial flexibility to do whatever it takes to get better with critical illness insurance.

CRITICAL ILLNESS

RETIREMENT INCOME

Just because you’ve stopped working doesn’t mean your money has to. Find out how you can invest your savings to provide a steady stream of income so you can enjoy your retirement years to the fullest. Different retirement income options for different needs.

Your retirement income will typically come from a number of different sources. You may be eligible for CPP/QPP and OAS or other government benefits – and you may have a company pension. But, if you’re like most Canadians, you also need to turn your savings into a retirement income stream to help meet your financial needs throughout retirement. With a range of products and features to offer, an advisor can help you choose the product or products that best fit your needs.

Annuity

An annuity guarantees you will receive an income for life, or as long as the annuity contract specifies.

Your retirement income will be secure from both market and interest-rate risks.

Segregated funds

There are a number of different types of segregated fund contracts that combine capital protection with growth potential.

Your savings will be protected. When your contract matures or when you die, your savings will be guaranteed to return a minimum of 75% up to 100% of the money you put in (less withdrawals).

Mutual funds

A mutual fund is a large pool of money belonging to many people that is invested by experts in stocks, bonds or other securities with the goal of increasing the value of the overall pool.

Mutual funds are often held in tax-advantaged retirement income plans as a way of participating in markets.

Guaranteed interest products

There are a number of guaranteed interest products that all offer protection for your initial investment and the opportunity for predetermined growth.

The guaranteed return is based on interest rates, the deposit amount, the length of the contract and other factors, depending on the type of product you choose.

You’ll have peace of mind knowing your savings are protected from market fluctuations.

Tax-advantaged retirement income

A registered retirement income fund (RRIF) is a tax-deferred way for you to use your RRSP savings to generate retirement income.

A life income fund (LIF) or locked-in retirement income fund (LRIF) is like a RRIF for “locked-in” money that originally came from a pension plan.

Don't let the bank decide where your benefit is applied.

Take control of your coverage to ensure it is given to the ones you love.

TRAVEL

Getting sick or hurt when you are away from home is stressful enough without having to worry about the cost of the medical care you need. Goldkey can help protect you, whether you are a travelling Canadian, a visitor to Canada or a student.

Travelling Canadians Plans

Single-trip All-inclusive Plan

Comprehensive travel coverage outside and within Canada

Up to $10 million in emergency medical benefits plus trip cancellation and trip interruption

Baggage loss, damage or delay

Flight accident and travel accident insurance

Multi-trip All-inclusive Plan

Comprehensive travel coverage outside and within Canada

Up to $10 million in emergency medical benefits

Trip cancellation and trip interruption

Baggage loss, damage or delay

Flight accident and travel accident insurance

Visitors to Canada

Do you have family or friends coming to stay? Do your guests have insurance to protect them while they’re here?

Goldkey can help protect against the cost of unexpected medical emergencies that may occur during their trip in Canada. Visitors to Canada Travel Insurance can be purchased prior to their departure from home or when they first arrive in Canada.

Canadians who are not eligible for benefits under a Canadian government insurance plan;

Persons who are in Canada on a work visa or Parent and Grandparent Super Visa; or

New immigrants who are awaiting government health insurance plan coverage.

t's easy to take our ability to perform day-to-day activities for granted. But this can change, especially as we age. This is why it’s so important to consider your future healthcare needs as you build and review your retirement savings and income plans.

Long Term Care Insurance

Protects against significant healthcare costs in retirement with the added security of protection against the impacts of severe illness or accident that can happen at any time

This plan offers a weekly benefit of $150 to $2,300

Shorter waiting periods of 90 or 180 days make it possible to begin receiving benefits sooner

Provides a first-payment bonus to help with costs incurred during the waiting period

Retirement Health Assist

Protects against the healthcare costs specifically associated with the realities of aging in the later stages of retirement

This plan offers a weekly benefit of $500 to $2,300

Longer waiting periods of 1 or 2 years for a lower-cost alternative

You will likely require care in retirement, to some degree, as you age and your health changes. The level of healthcare and personal assistance you need – and the cost to meet those needs – typically increase over time and go through 5 stages. Understanding these stages and how they change over time can help you plan for the future, contact us to see how we can help each stage of your retirement plan.

Long Term Care

©2023